best in class Asset Management

Balancing Returns with a Deep Understanding of Risk

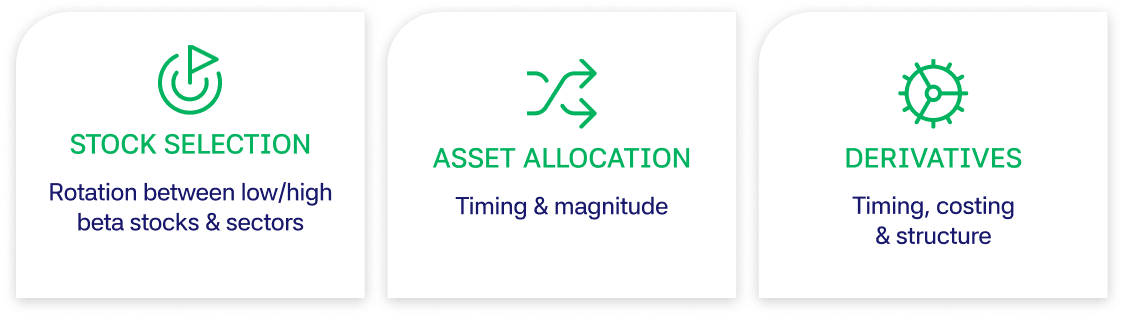

At AssetPilot, we know higher returns often come with higher risk – but not always in a predictable way. That’s why we focus just as much on understanding and managing risk as we do on delivering returns. Below is a look at some of the tools we use to support this approach.

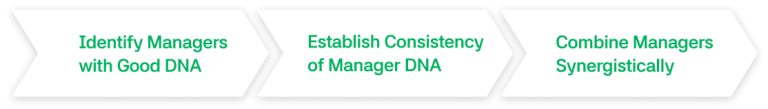

Find Best in Class Fund Managers

With thousands of funds out there, our first priority is to identify managers with a proven track record or as we call it, strong investment DNA. We look for those who consistently deliver strong results in their area of expertise, guided by the risk metrics that matter most.

Blend Managers Synergistically

We then blend these managers together to achieve diversification that leads to consistent outcomes.

Factor Analysis

We track key market factors and how they influence your portfolio. Using capture ratios and scenario analysis, we identify the main drivers of performance. Our focus isn’t on predicting the future – but on managing the risks and opportunities it may bring.

Factors

Performance Ranking and Back Testing

Conduct full performance rankings against the managers’ respective peer groups as well as back testing performance for each manager and the overall portfolio using historical data to see how the manager would have fared in the past.

Qualitative Analysis

Due diligence processes on current, existing and potential managers are conducted, helping us combine all of our analyses into a comprehensive understanding of an individual manager. This qualitative process serves as a guide to help us tie in what is observed in the quantitative process and essentially checks the box of whether the manager is true to their “DNA” as identified in various processes.

Information Rich Client Reporting

The results are all presented in information rich client reporting.

Model

Inception date

Objective

Reg. 28 Compliant

Peers

Benchmark

DFM Fee

Time Horizon

Risk Profile

Flexible Income

14 August 2017

Cash plus

Yes

SA MultiAsset Income Sector

STeFI

0.1% p.a (excl. VAT)

2 years

Inflation Plus 2-3

30 September 2015

CPI + 2-3%

Yes

SA MultiAsset Medium Equity Sector

CPI + 2%

0.2% p.a (excl. VAT)

2-3 years

Inflation Plus 4-5

30 September 2015

CPI + 4-5%

Yes

SA MultiAsset High Equity Sector

CPI + 4%

0.2% p.a (excl. VAT)

4-5 years

Inflation Plus 6-7

30 September 2015

CPI + 6-7%

Yes

SA MultiAsset High Equity Sector

CPI + 6%

0.2% p.a (excl. VAT)

6-7 years

Flexible Growth

2 November 2015

Long term capital growth

No

Multiple

40% MSCI World,

25% JSE ALSI,

30% STeFI

5% SA Property

0.2% p.a (excl. VAT)

8+ years